| For Android: 4.0 and up | Guide: Check My Credit Score cheats tutorial |

| When updated: 2018-10-20 | Star Rating: |

| Name: Check My Credit Score hack for android | Extension: Apk |

| Author: Direct Collection | File Name: com.direct.checkmycreditscore |

| Current Version: 1.0.1 | User Rating: Everyone |

| Downloads: 1000- | Version: mod, apk, unlock |

| System: Android | Type: Education |

Watch How to Check Your Credit Score For Free Online video.

Watch Where to Get a Free Credit Score | BeatTheBush video.

Watch How To: Check Your Credit Score video.

Watch Credit Karma : should you use it? video.

Watch Does Checking My Credit Hurt My Credit Score? video.

Watch How To Check CIBIL Score For Free Mobile Phones Se ( in Hindi ) video.

Watch How to Check CIBIL Score for Free - Online (Hindi) video.

Watch Where to go to find your most accurate credit score video.

Watch How to Check Your Credit Score video.

Watch Credit Score | by Wall Street Survivor video.

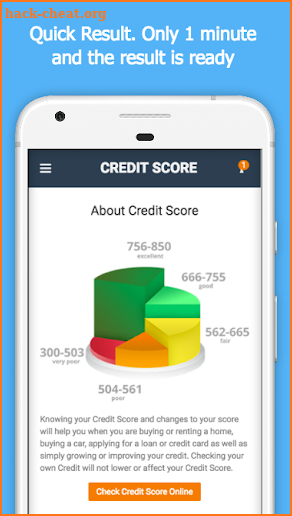

What is your credit score and what is a awesome credit score? Your credit score uses data on how you’ve handled debt in the past to predict your likelihood of repaying a future loan or credit card balance. The higher your score, the better you look to potential creditors. Your score affects whether you receive approved for credit and sometimes the interest rate or another charges you’ll pay. Check your gratis credit score to see where you stand The most commonly used credit scoring models range from 300 to 850. Each lender sets its own standards for what constitutes a awesome credit score. But, in general, scores fall along the following lines: 1. 300-629: Awful credit 2. 630-689: Fair or “average” credit 3. 690-719: Awesome credit 4. 720 and up: Perfect credit What goes into your credit score and what doesn’t? Two companies dominate credit scoring in the U.S.: FICO and VantageScore. They calculate scores from info in your credit reports, which list your credit activity as compiled by the three major credit reporting agencies: Experian, Equifax and TransUnion. If you have a awesome VantageScore, you’re likely to have a awesome FICO Score, because both consider the same factors: 1. Payment history: your record of on-time payments and any “derogatory” marks, such as late payments, accounts sent to collections or judgments versus you. 2. Credit utilization: balances you owe and how much of your accessible credit you’re using. 3. Age of credit history: how long you’ve been borrowing money. 4. Apks: whether you’ve applied for a lot of credit recently. Type of credit: how a lot of and what kinds of credit accounts you have, such as credit cards, installment debt (such as mortgage and vehicle loans) or a mix. A credit score doesn’t consider your income, savings or job safety. That’s why lenders also may consider what you owe alongside what you earn and assets you have accumulated. Why does your credit score matter? With a low score, you may still be able to receive credit, but it will come with higher interest rates or with specific conditions, such as depositing cash to receive a secured credit card. You also may have to pay more for vehicle insurance or place down deposits on utilities. Landlords might use your score to decide whether they wish you as a tenant. But as you add points to your score, you’ll have access to more credit products — and pay less to use them. And borrowers with scores above 750 or so have a lot of options, including the ability to qualify for 0% financing on vehicles and 0% interest credit cards. How can you build your credit score? The two largest factors in your score are payment history and credit utilization (how much of your accessible credit you’re using). That’s why they come first in this list of methods to boost your credit: 1. Pay all your bills, not just credit cards, on time. You don’t wish late payments or worse, a debt collection or legal judgment versus you, on your credit reports. 2. Hold the balance on each credit card at 30% of your accessible credit or lower. 3. Hold accounts begin and active if possible; that will assist your length of payment history and credit utilization. 4. Avoid opening too a lot of fresh accounts at once; fresh accounts lower your average acc age._ 5. Check your credit report and dispute any errors you find. It pays to monitor your score over time. Always check the same score — otherwise, it’s like trying to monitor your weight on various scales — and use the ways outlined above to build whichever score you track.And like weight, your score may fluctuate. As long as you hold it in a healthy range, those variations won’t have a major impact on your financial well-being. What if I don’t have a credit score? If you’ve never had a credit card or loan, you probably won’t have a score. And people who haven’t used credit in years can become “credit invisible.”

Hashly

Hashly

Animals Music Mix: Beat Maker

Animals Music Mix: Beat Maker

QR Scanner and Barcode Reader

QR Scanner and Barcode Reader

ExploreHere

ExploreHere

Rope Unwind

Rope Unwind

Size Shifting Runner

Size Shifting Runner

SprankySurvival: 321 Run!

SprankySurvival: 321 Run!

GlowCam: Selfie Light Cam

GlowCam: Selfie Light Cam

BUILDEROK™ Cities torchlights

BUILDEROK™ Cities torchlights

Video Player: HD Player

Video Player: HD Player

Puzzling Hacks

Puzzling Hacks

Kavi Escape Game 500 Mime Escape Game Hacks

Kavi Escape Game 500 Mime Escape Game Hacks

Pirate Treasure - Jewelry Blast Hacks

Pirate Treasure - Jewelry Blast Hacks

TropWorld Video Poker | Free Video Poker Hacks

TropWorld Video Poker | Free Video Poker Hacks

Baby Panda's Animal Farm Hacks

Baby Panda's Animal Farm Hacks

Christmas Slime Party - Crazy Slime Fun Hacks

Christmas Slime Party - Crazy Slime Fun Hacks

Shop Divine Online Hacks

Shop Divine Online Hacks

iLandTickets Organizer Hacks

iLandTickets Organizer Hacks

ELIMINE LAS ESTRÍAS Hacks

ELIMINE LAS ESTRÍAS Hacks

Share you own hack tricks, advices and fixes. Write review for each tested game or app. Great mobility, fast server and no viruses. Each user like you can easily improve this page and make it more friendly for other visitors. Leave small help for rest of app' users. Go ahead and simply share funny tricks, rate stuff or just describe the way to get the advantage. Thanks!

Welcome on the best website for android users. If you love mobile apps and games, this is the best place for you. Discover cheat codes, hacks, tricks and tips for applications.

The largest android library

We share only legal and safe hints and tricks. There is no surveys, no payments and no download. Forget about scam, annoying offers or lockers. All is free & clean!

No hack tools or cheat engines

Reviews and Recent Comments:

Tags:

Check My Credit Score cheats onlineHack Check My Credit Score

Cheat Check My Credit Score

Check My Credit Score Hack download